Somehow it’s been 10 years since I finished university. With this week’s news about the new student loan repayment tool, I thought I would write a post looking at my student loan repayment over this time (Disclaimer: I actually started writing this post weeks ago, it’s just fortuitous that it’s in the news at the same time).

I started university in 2006, the first year that the (then) new and ridiculously expensive tuition fees of £3000/year came in. For a four year course, this amounted to £12,000. I also received the maintenance loan at another £3000/year. In fact, each year was slightly higher than the previous year because of inflation, and on top of this, interest was added from day 1, so that by the time I graduated, I owed £26,823.07.

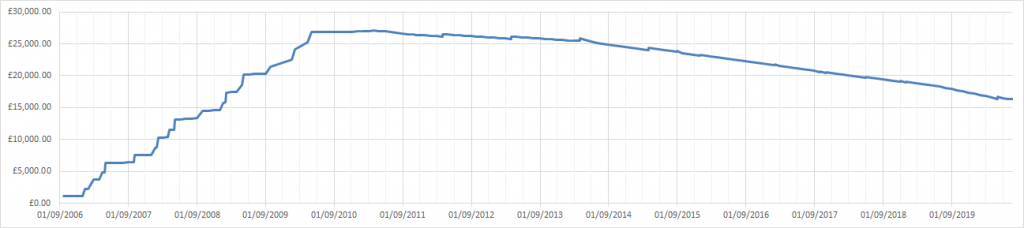

This doesn’t start getting paid back until the April after graduation, so when I did start paying it off, it had reached a total of £27,056.05.

The repayments are based on a percentage over a certain earning amount. As a recent graduate, my starting salary wasn’t especially high and so my first repayment in April 2011 was £52. And whilst I don’t have the exact figure, the loan gained approximately £35 in interest that month. This certainly wasn’t going to be quick to repay.

Fast forward 9 and a bit years from when I started repaying and (as of today) I’m down to only owing £16,365.82. By my estimation that’s around 40% paid. At the current repayment amounts and interest rates I should be paid off in just under 7 and a half more years.

Having produced a graph of the amount owed over time, I was hoping it would highlight some really interesting trends but there’s not really much to say about it. For the first couple of years, the repayments were only slightly higher than the interest gained and so the total mostly flat-lined. Increased wages (most noticeable in early 2014) have caused the total to decrease quicker. There have been some drops (and rises) in the interest rate and in the earnings threshold too, but these have been relatively small and have had less impact on how quickly it’s paid off (possibly balanced out by salary inflation?). Without any major increases to my salary or the interest rate (both fairly unlikely), the downwards trend should continue at its current rate.

What does seem sure (at least at the moment) is that I’m not going to get to the 25 year point where any outstanding debt is written off. Come back in another 7 years and 4 months to see how things have gone.